3 Unsettling Truths about Neighborhood Segregation

The Black Lives Matter movement is forcing many white people to open our eyes to inequalities we have long ignored. One such issue is neighborhood segregation and unequal access to homeownership.

Since the Fair Housing Act passed in 1968, the gap between Black and white homeownership rates has widened—growing from 27 percentage points in 1960 to 30 points in 2017—and the Black homeownership rate has actually stayed almost exactly the same.

After many years of silence, white communities are beginning to talk about the ways segregation shuts Black, Indigenous, and People of Color out of opportunities to gain wealth, attend well-funded schools, and be safe in their homes.

Many white people are asking, “What can I do?”

Before we can take any action to desegregate our neighborhoods, we need to understand three unsettling truths about neighborhood segregation.

Truth 1: The segregation of our neighborhoods was deliberate, legal, and rooted in racist lies.

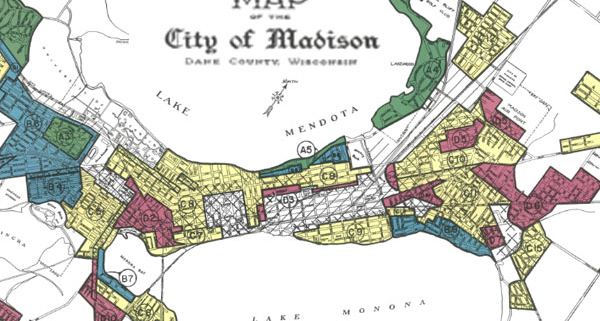

In 1933, The Home Owners Loan Corp created a system called redlining, that was institutionalized in 1937 by the federal government, which made it legal to exclude Black homebuyers from obtaining a mortgage. Pervasive racist stereotypes depicted Black Americans as violent, lazy, and welfare-dependent, making their neighborhoods risky investments.

Without access to mortgage insurance, Black residents fell prey to real estate speculators, who convinced white homeowners to sell at low prices based on the fear that Black people were moving into their neighborhoods—a process known as blockbusting. Those speculators then either sold the homes to Black residents in predatory contract sales or charged them with inflated rents. In most cases, Black homebuyers lost their homes with no wealth generated after years of investments.

Truth 2: Racial prejudice and discrimination in real estate continue to present unequal barriers to homeownership for BIPOC.

In November 2019, after conducting a three-year study, Newsday found that Black homebuyers in Long Island were discriminated against in 49% of interactions with real estate agents, as compared to the experience of a white buyer with the same financial details. The forms of discrimination were so subtle that most participants of color in the survey did not know they had been treated differently until they heard the experience of their white counterparts.

In my career, I have seen agents require Black or Brown buyers have a preapproval letter prior to showing homes while agreeing to show homes to white buyers who aren’t yet pre-approved. I’ve seen lenders decline Black buyers at much higher rates than white buyers in the same financial position. And I’ve seen agents only show buyers of color homes in diverse neighborhoods, and only show white buyers homes in mostly-White neighborhoods.

Because of the commission-based pay structure for real estate agents, and because many first-generation homebuyers are buying in lower price ranges, BIPOC often work with novice agents who don’t have the experience and knowledge to properly protect clients and guide them through the process successfully.

In Black and Brown communities, home-buying horror stories abound—getting ripped off in the loan terms, a closing falling through because the agent didn’t know how to navigate the downpayment assistance program, getting no’s from five lenders before getting a yes, etc. These stories, and the overall lack of education around the benefits of home buying from a wealth-building perspective, create a negative stigma around home buying for Black and Brown communities.

Truth 3: White homeowners continue to benefit from the discrimination of the past and the present.

The racial wealth gap, which as of 2016 stood at more than $150,000, according to Brookings, is directly attributable to the expansion of homeownership for Whites at the expense of Blacks during the post-war period of the ‘40s and ‘50s. This gap means white families today are much more likely to get help from family members with down payments and avoid foreclosure if they experience a sudden loss of income.

The unconscious biases of the real estate industry mean buyers of color slog through barrier after barrier, while White buyers get a red-carpet experience and gain access to the best homes in the hottest markets with the best schools. Modern discrimination and lack of fair housing policies limit the housing options of BIPOC to overpoliced neighborhoods, increasing their chances of experiencing incarceration, which in turn limits their access to the workforce. The cascading effects of racism in real estate are endless.

When we fully understand and own these unsettling truths, when we thoroughly explore the history behind them, when we let them dig into our collective soul, they make us question everything about the status quo.

And then, and only then, can we begin to desegregate our neighborhoods.

Want to learn more? You’re invited to a virtual seminar on 9/26/2020…

Untold Stories About “Good” Schools and Neighborhoods.

Location, Location, Location…Realtors know the truth in that phrase and so do Teachers. The underlying messages of the “good” schools or the “bad” neighborhoods is a conversation that is long overdue in many circles. It means we need to talk about money, resources, home prices, free and reduced lunch statistics which all mean different things to different people.

Join Sara Alvarado and Ananda Mirilli for some virtual Saturday morning inspiration, intellectual stimulation, and heart expansion.

Tickets are available on a sliding scale from $20-$50. Get your ticket here.

Leave a Reply

Want to join the discussion?Feel free to contribute!